Tax Scale data is provided by the Australian Taxation Office.

This document allows the user to import or enter data for use in the LILAC payroll system.

A Tax Scale must be included for each Employee at: Documents > Payroll > Employee Details.

Tax Scale 2 is the most common scale used for employees.

This document allows the user to import or enter data for use in the LILAC payroll system.

A Tax Scale must be included for each Employee at: Documents > Payroll > Employee Details.

Tax Scale 2 is the most common scale used for employees.

Page 1

LILAC Document Help

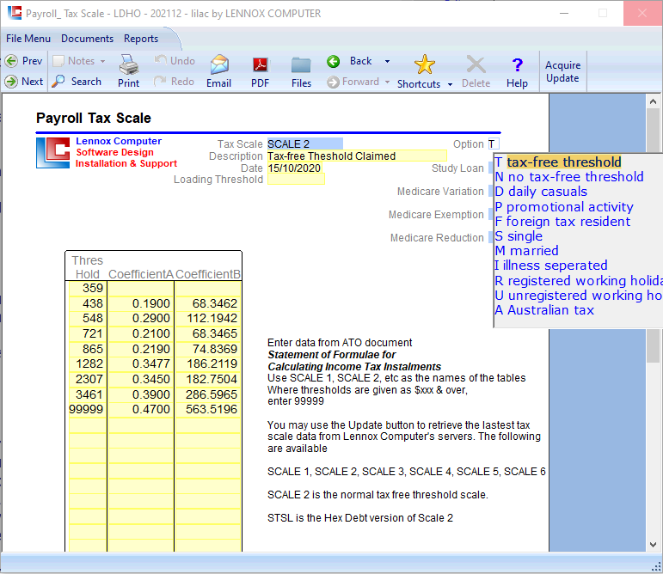

Payroll Tax Scale

Help Page: Payroll > Single Touch Settings

Select a previously acquired Tax Scale. Or, enter a new Tax Scale key and 'Acquire Update' from the ribbon, which will populate the table below.

It is MANDATORY for each Tax Scale to have a entry in the Option Field.

Acquire Update

'Acquire Update' from the ribbon will update a (single) selected Tax Scale with the current ATO Tax Scale information. This is required only during setup or in the event of the ATO editing Tax Scales.

For example, selecting 'SCALE 2' and click 'Aquire Update' will re-populate the table with the latest data from the ATO, and re-fresh the Date field.

Each Tax Scale is re-populated individually with 'Acquire Update' to get all Tax Scales (SCALE 1 through 6) as necessary.

For example, selecting 'SCALE 2' and click 'Aquire Update' will re-populate the table with the latest data from the ATO, and re-fresh the Date field.

Each Tax Scale is re-populated individually with 'Acquire Update' to get all Tax Scales (SCALE 1 through 6) as necessary.